Research carried out by Rystad Energy which examines the lasting impacts of Covid-19 and the energy transition has led it to significantly revise its long term oil demand forecast. However not all producing countries were affected in the same way.

Oil And Gas Project Sanctioning To Decline By More Than 75 Rystad Energy Claims Offshore

As Covid-19 infections continue to increase around the world and the implications of the pandemics spread are acknowledged in key markets in the Americas and Asia Rystad Energy is now changing its base case scenario for oil demand incorporating a mild second wave effect.

Rystad energy covid. The updated base case scenario assumes a temporary pause in global demand recovery as the reopening of Europe and other regions is offset by Covid-19 outbursts in populous and high oil-consuming countries in the Americas and Asia such as the United States Brazil and India. Coronavirus covid-19 rystad. Indias COVID Crisis Could Result In Global Oil Glut.

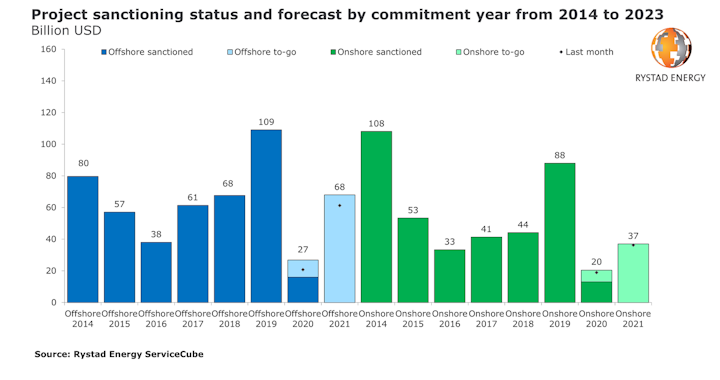

The rise of Covid-19 cases in the US is of particular concern for the oil market given the countrys high oil consumption under normal circumstances as this second wave could paralyse road fuel demand. The Covid-19 pandemic has devastated global oil and gas project sanctioning this year and will cause total committed spending to drop to around 53 billion from 2019s 190 billion Rystad. By monitoring recent developments.

Covid-19 Brings Peak Oil Date Closer. 29 2021 0700 AM. OSLO Norway Global EP revenues could fall by around 1 trillion this year to 147 trillion compared with 247 trillion in 2019 according to Rystad Energy.

We have now published the 4th edition of our COVID-19 Report. To get access to the public version of the report you can sign up Rystad Energys Free Solutions below. Rystad Energy is now changing its base-case scenario for oil demand banking on a second wave of Covid-19.

Rystad Energys comprehensive Covid-19 monthly report calculates the effect of the pandemic on our lives and offers updated estimates for global energy markets. The Covid-19 downturn will expedite peak oil demand putting a lid on exploration efforts in remote offshore areas and as a result reducing the worlds recoverable oil by around 282 billion barrels Rystad Energy said in its annual global energy. It has now lowered its estimated for 2021 from 252 trillion to 179 trillion.

Now this estimate has been lowered to 3962 bcm this. A mild second wave of Covid-19 is now Rystad Energys base case scenario for oil demand. Indias worsening COVID outbreak is set to disturb the nearly.

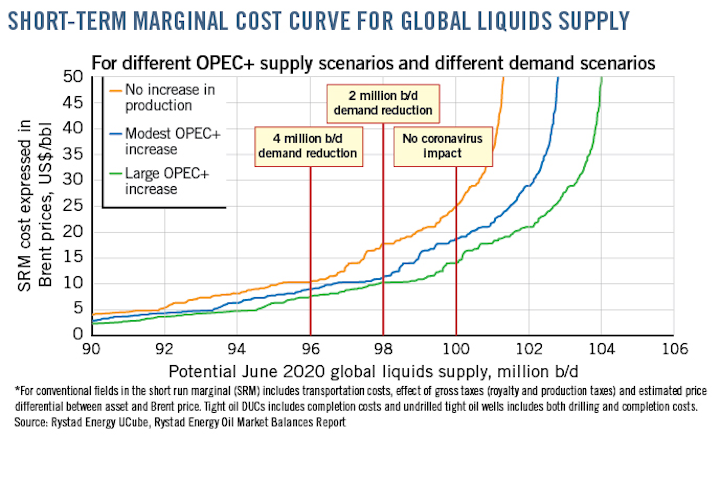

The virus is expected to have a lasting impact on global oil demand which it now sees peaking at 102 MMbd in 2028. Rystad Energys COVID-19 Report will be regularly updated offering scenario analyses and evaluating the. Our CEO Jarand Rystad is updating you on the key takeaways and highlights of this weeks.

OSLO Norway The COVID-19 pandemic and the acceleration of the energy transition have led Rystad Energy to revise its long-term oil demand forecast. The OPEC alliances recent agreement to steadily increase oil production is paving the way for Russia to slowly shrug off COVID-19. Prior to the spread of COVID-19 the consultant anticipated revenues of 235 trillion in 2020.

Before COVID-19 Rystad Energy expected total natural gas production to rise to 4233 billion cu m bcm in 2020 from 4069 bcm last year. Rystad Energys public version of the COVID-19 Report will be updated monthly offering scenario analyses and evaluating the impact on global energy markets. Russias oil supply set to break COVID-19 chains.

The Covid-19 pandemic not only devastated oil demand in 2020 but also forced the global oil and gas industry to severely downsize its staffing levels. North America notably the lower US states the Middle East and Southeast Asia will be hit relatively harder Rystad Energys modelling shows. April 29 2021 1100 AM.

We have now published our second edition of the COVID-19 Report released on March 17. A Rystad Energy analysis shows that the worlds top oil and gas employer China lost only 53 of its massive workforce. The new assumption for the base case now incorporates a mild second wave of the.

Rystad Energys COVID-19 Report is now available our CEO Jarand Rystad explains what the report is about and highlights the key takeaways. Indias COVID Crisis Could Result In Global Oil Glut.

Rystad Russia S Oil Supply Set To Break Covid 19 Chains Oil Gas Journal

Rystad Energy On Twitter Us Fracking Set For The Biggest Monthly Decline In History As Oil Prices Collapse And Covid 19 Persists Full Article Here Https T Co Dcjjjdyfds Rystadenergy Energy Oilandgas Fracking Https T Co Sis3o1v93p

Rystad Energy On Twitter Global E P Capex Will Reach At Least A 13 Year Low In 2020 As Covid 19 And Price War Persist Full Story Here Https T Co Tqotgbfoxf Rystadenergy Energy Oilandgas Exploration Production

Rystad Energy 20 Bbl Oil Not Far Off Oil Gas Journal

Uzivatel Rystad Energy Na Twitteru Covid 19 Monthly Update 2020 S Oil Demand Recovery Slows Down Road Fuels Upgraded For 2021 Full Update Here Https T Co Mqeywe9y85 Rystadenergy Energy Energymarkets Oildemand Covid19 Coronavirus Https

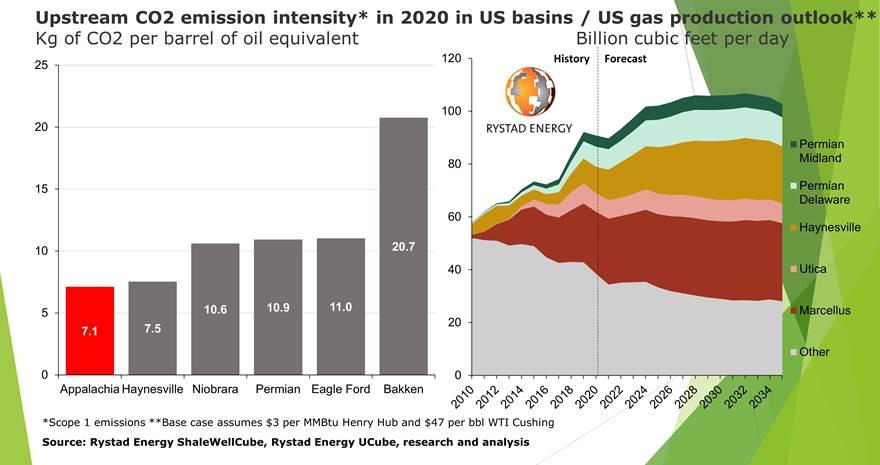

Us Gas Production To Hit Record Levels In 2022 Rystad Energy Oil Gas Middle East

Rystad Energy Gas Market Analytics

Upstream Spending Will Struggle To Recover To Pre Pandemic Levels Says Rystad Maju Saham

Rystad Energy Rossiya Mozhet Vyjti Na Rekordnye Pokazateli Neftedobychi Uzhe K Letu 2022 Goda

Rystad Energy Covid 19 Job Toll Top O G Employer China Resilient Us Takes Larger Hit Than European Peers

Rystad Energy Offshore Hydrocarbon Exploration In Australia For 2019 Is Expected To Rise To The Highest Level Since 2014

Rystad Us Producers See Cost To Supply Lng To Asia Increase Oil Gas Journal

Rystad Energy Qatar S Attempt To Reclaim The Lng Throne Will Make Middle East 2021 S Global Sanctioning Epicenter

World S Recoverable Oil Now 9 Slimmer Rystad Energy Oil Gas Middle East

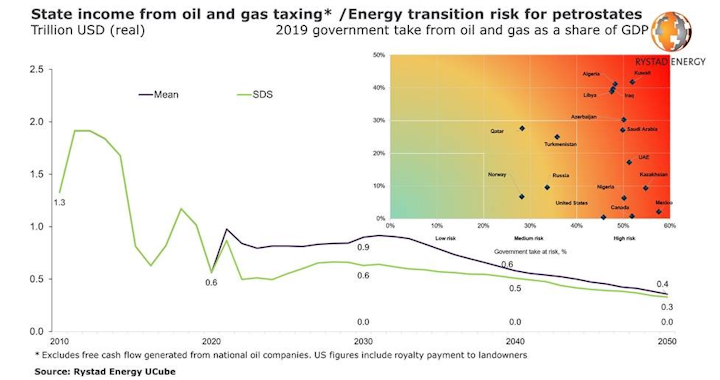

Rystad Accelerating Energy Transition Marks End Of Trillion Dollar Oil And Gas Tax Revenues Oil Gas Journal

Rystad Energy Us Onshore Oil Producers To Keep 2021 Output In Check Even As Prices Rise

Rystad Energy Big Oil Faces Major Reserves Challenge As New Discoveries Fail To Replace Production